37 Uses For Life Insurance

Follow Scott Karstens

When you think of life insurance, do images of the beige-colored pamphlets with tiny text roll into your mind? Life insurance can seem intimidating and too “adult” to many young professionals, business owners, new families – and even busy moms or busy executives! But life insurance is so much more than that. In actuality, it’s one of the most powerful tools in tactical financial planning – and one that everyone should consider adding to their portfolio. To prove how useful it really is – here are 32 fantastic uses for life insurance! So grab a cup of coffee (or rosé!) and get ready to rethink what you know about this financial product.

Instant Decision Life Insurance

You can quote, customize and buy life insurance in 10 minutes or less! No need to wait to speak to an agent, you got this!

Table of Contents

Table of Contents

Click on a topic or scroll through.

Don’t get overwhelmed, click on a topic in the table of contents that interests your or just keep scrolling down.

- Life Insurance For the Modern Family

- Income Replacement

- Mortgage Replacement

- Education Fund

- Emergency Fund

- Special Bequests

- Locking In Future Insurability

- Completing a Retirement Accumulation Plan

- Special Needs Planning

- Peace of Mind & Stress Relief

- Divorce

- Remarriage

- For Foster Families

- For Families With Adopted Children

- For Grandparents Raising Grandchildren

- For Families with Two Dads

- For Families with Two Moms

- Using Life Insurance to Pay Final Expenses

- Using Life Insurance to Provide an Inheritance

- Using Life Insurance to Secure & Pay Off Debt

- How to Use Life Insurance While You’re Still Alive

- Life Insurance for Business Owners

Life Insurance For the Modern Family

Income Replacement

Income replacement is a very valuable component of planning and is especially helpful in life insurance planning. The income replacement approach is a method of estimating the total amount of money you would need today to replace your income in the event of death. This approach takes into account factors such as salary and any additional sources of income, time horizon (how long you want to provide income replacement for your family), and what rate of return you believe you can receive on invested money.

To read more about this concept click here. If you want to see how this could fit your situation, we have created an easy solution for you to determine how much life insurance you will need to replace your income, and then you can customize and apply for coverage. You can do all of this in less than 10 minutes.

Mortgage Replacement

A mortgage replacement plan is utilizing a life insurance policy designed specifically to pay off your mortgage in the event of an untimely death. With this plan, you can ensure that your family won’t have to worry about making large monthly payments or ending up out on the street.

We have a solution that helps you design your own Mortgage Replacement plan. These plans are easy to set up and can be tailored specifically for your needs. You choose how much coverage you need, when it kicks in, and how much money gets paid out upon death. Our process also allows you to customize your coverage so that it fits your budget and provides your loved ones with the peace of mind they need if something happens..

To read more about this concept click here. If you want to see how this could fit your situation, we have created an easy solution for you to determine how much life insurance you will need to replace your income, and then you can customize and apply for coverage. You can do all of this in less than 10 minutes.

Education Fund

College. A four-letter word that can strike fear and dread into the heart of any parent. How will you pay for it? What if something happens to you before your child is ready to go to college? The most cost-efficient answer is a term life insurance plan, which is designed to provide peace of mind for you and your family in the event of an unexpected tragedy.

Emergency Fund

An emergency fund is exactly what it sounds like; money stashed away that can be used in times of financial distress and is typically equal to 3 – 6 months of income. The purpose of an emergency fund is to improve financial security by creating a safety net that can be used for unanticipated expenses, or sudden life changes. It’s not something that should be used lightly because according to The Fed, between retirement and savings, most 35-44 yr olds only have around $39,000 saved up. That means if you or your spouse died unexpectedly, your family could use up all of their savings, including retirement, just to keep on their feet. Term life insurance is an excellent source for emergency fund planning should the unexpected happen. For just pennies on the dollar, you can provide some breathing room for your loved ones as they grieve and get back on their feet.

Special Bequests

A specific bequest is when an individual identifies in their will which item or asset they want to leave to each beneficiary. This could include jewelry, art, money, real estate and other tangible items. It also includes intangible items such as patents, royalties, copyrights and even digital assets such as domain names or social media accounts. To further clarify – if you have three children, you can specify which item or asset goes to which one of them by using the language of “specific bequests” in your will or trust document. This allows for clarity and avoids any potential confusion about who receives what after you are gone. Life insurance can be a welcomed part of specific bequests in situations where not every child or grandchild can receive an item to specifically give to them.

Locking In Future Insurability

It’s important to consider that not everyone has the luxury of being able to purchase a life insurance policy later in life due to medical issues or age-related restrictions. Term life policies offer an easy solution through their conversion privilege: as long as the policyholder converts before their term expires (typically 10-30 years), they can convert their existing policy into a permanent one without undergoing another medical exam—even if their health has declined since taking out the original policy! As such, even if someone develops a condition that would otherwise disqualify them from buying any kind of coverage later in life, they can still get some peace of mind knowing that they have locked in coverage during their younger years. This conversion privilege typically allows you to convert what you can afford vs requiring the full policy to convert.

In addition to this, you can also buy Child Insurance Riders to cover your children under the same life insurance policy as you. This rider allows your child to convert their coverage up to 5x what you provided, sometimes more. No one likes to think of the insurability of your children being a potential issue, but it is becoming more common.

Completing a Retirement Accumulation Plan

Losing a spouse is one of the most difficult experiences anyone can go through. It can be emotionally and financially devastating, especially when it happens suddenly and unexpectedly. One of the biggest financial impacts of a spouse’s untimely death is on the retirement plans of the surviving spouse. A few things you can expect to be adversely affected in retirement plans when a spouse dies:

-

- Loss of matching 401k or retirement contributions

- Loss of health or other benefits

- Loss of income funding other retirement plans

A properly structured life insurance plan can provide the funding necessary to fill in the gap between what you wanted to do for retirement and where you are currently in your retirement savings.

Special Needs Planning

Special needs trusts don’t typically buy life insurance policies. However, a trust is often the beneficiary of a policy. Parents set up a trust to hold assets and help pay for their child’s lifetime care after they are gone. Then, the parents designate the trust as the beneficiary of their life insurance policy.

Setting up a special needs trust doesn’t generally involve buying a separate life insurance policy for your child with disabilities since doing so could potentially reduce or eliminate government benefits they were receiving at the time of your passing—which defeats the very purpose of creating an SNT in the first place! However, designating your existing policy as a beneficiary of your special needs trust is often recommended since it allows those death benefit payments to pass directly into your trust where they can be used to cover any additional care costs in accordance with its terms without any delay due to probate proceedings. That way everyone wins!

Peace of Mind & Stress Relief

At the end of the day, having life insurance provides peace of mind knowing that if something were to happen to you, your family would be taken care of financially. That alone makes it worth investing in a good policy—because nobody wants their loved ones left with debt or financial strain after they’re gone!

Divorce

Going through a divorce is emotionally draining, to say the least—but don’t forget that it also involves some practicalities too. One of them? Updating your life insurance policy so that you and your former partner are both properly covered in the event of any unfortunate happenings. This is an important part of helping make one or both spouses whole if the unexpected happens, but more importantly, if you have kids it helps keep them whole if the unexpected happens. This often requires a new policy on one or both spouses to fully complete, but it doesn’t mean you need to cancel your old policy.

Remarriage

For many couples who enter into their second marriage, life insurance can provide peace of mind knowing that their partner will be taken care of if something were to happen to them. But what about if either of you has kids from your first marriage? It’s especially important if one partner has children from a previous relationship that you consider thoughtfully providing enough life insurance to help ease any potential tension with the new relationship (especially if they are older children). Life insurance can help ensure that your new spouse and any kids brought into the new family have their future taken care of in case of any unexpected circumstances.

For Foster Families

Life insurance gives you peace of mind knowing that if something happens to you, your family will be taken care of financially for years to come. And this holds especially true for foster families. Since fostering can often involve taking on several children at once, a financial cushion can make all the difference in providing them with stability and security in an uncertain time. This allows your surviving spouse or sometimes adult children to be in a position to continue providing the love and care needed for the kids you take care of.

Additionally, life insurance also provides coverage for critical illnesses like cancer and stroke, which could really come in handy if you had an unexpected event. You can also add disability income coverage to your life insurance which would provide some income to make sure you can pay your mortgage or grocery bills or more if you become disabled. These types of coverage would allow you to focus on their recovery without worrying about how you will afford medical bills or lost wages due to missed work.

For Families With Adopted Children

Having life insurance in place can give adoptive parents peace of mind knowing that their child will be taken care of if something happens to them. It allows parents to prepare for any eventuality, ensuring that their child will have the financial security they need if something happened to the primary breadwinner in the family. Additionally, having a life insurance policy can help adoptive families cover legal fees associated with adoption or guardianship proceedings in case something happens to them before they are finalized.

In addition to providing financial security, there are other benefits that come with having a life insurance policy as an adoptive family. First and foremost, it helps protect your adopted child’s rights and interests should something happen to you or your partner. Having a solid plan in place can ensure that your adopted child will receive all the benefits they are entitled to under the law should something happen. It also provides assurance that your child will be taken care of financially after you’re gone; this can be especially helpful if you don’t have other family members who can step in and provide support.

For Grandparents Raising Grandchildren

Life insurance provides financial security in case something happens to the primary caregiver—in this case, you. It ensures that if something were to happen to you, your grandchild would still have access to financial support. That’s especially important if your grandchild isn’t able to rely on their parents due to a variety of circumstances (for instance, if they are incarcerated or unable to provide).

Another benefit of having life insurance when you’re raising a grandchild is that it can help cover costs associated with medical bills and other expenses related to their well-being. And no matter how old your grandchildren are, life insurance offers peace of mind knowing that they will be taken care of financially should something happen to you.

For Families with Two Dads

As a parent, it’s your job to protect your kids from the world and make sure they have everything they need. But what about when you’re not around? Recently, life insurance companies have started offering policies specifically tailored for families with two dads. These policies are designed to provide children with financial security in the event of something happening to one—or both—of their parents.

Life insurance to protect your kids is important because it helps provide financial stability for them in the future. It can pay for education expenses or medical bills, or even just provide an extra cushion of protection as they grow older. This type of policy also lets your children know that they are taken care of and loved, even if one or both parents pass away before they become adults.

For Families with Two Moms

It may seem strange that you need life insurance for your children when they are still young, but life insurance provides peace of mind in case something happens to one or both of the parents. It ensures that their financial needs—from healthcare costs to education funds—are taken care of if one or both of the parents pass away. Additionally, life insurance can also provide an inheritance if both parents die prematurely.

For families with two moms, life insurance companies today recognize same-sex partners as legal spouses – even those living in states where same-sex marriage is not legally recognized—are given equal protection when it comes to life insurance.

Using Life Insurance to Pay Final Expenses

Paying State Death Tax

Do you remember the saying, “Nothing is guaranteed but death and taxes”? When it comes to estate planning, many people may think they don’t have enough money to worry about estate planning or how to best leave behind an inheritance for their loved ones. What many don’t consider is the tax implications of those inheritances. This can be particularly important in states with high estate taxes—like Hawaii and Washington—where the top rate of taxation on estates is 20%. While not every state has an Inheritance or Estate tax, around 16 states do. And in some states taxation begins on every dollar above $1,000,000. Life insurance can help you smartly plan for this expense.

Paying Federal Estate Tax

Federal estate taxes are taxes imposed on an individual’s assets at the time of their death. Assets can include anything from a car to real estate to investments. When these assets exceed certain amounts, they can be subject to federal estate tax at the time of death (or upon transfer). The amount of tax owed depends on how much value is transferred over the lifetime exclusion amount or “exemption” ($12.06 million per spouse in 2022). The exemption increases each year based on inflation, so if you have more than $12.06 million in assets, you may be subject to federal estate taxes (and your beneficiaries only have 9 months to come up with the money). The estate tax exemption also changes at or near the expiration of limits set by congress, the next round of changes are scheduled for 2025 and could bring significant change. Life Insurance provides an affordable way to offset some or all of these taxes to your family.

Paying For Income in Respect of Decedents Tax

When someone dies, they may still have income that was earned or accrued prior to their death. This income would be included on their final tax return and known as “income in respect of a decedent (IRD).” It includes wages, pensions, Social Security benefits, annuities, investments, and other forms of income. IRD must be reported on the deceased person’s final tax return unless it has already been included on previous returns. Life insurance can provide the needed funds to cover this final tax return.

Paying For Burial and Funeral Related Expenses

Using term insurance to cover burial and final expenses is an affordable way to provide protection for yourself or a loved one in the event of death. This type of life insurance can cover the cost of funeral homes, burial expenses, medical bills, and other final expenses when you die. For example, the life insurance company pays a surviving spouse a death benefit which can be used for preparation, memorials, paying for a funeral, making arrangements for cremation and more.

Using Life Insurance to Provide an Inheritance

Creating an Estate

Life insurance policies offer death benefits that can be used to create an estate. These benefits are paid out upon the death of the insured person, usually with tax advantages. This means that if you were to die while holding a life insurance policy, your beneficiaries would receive a large sum of money (minus any fees). This money can then be used to create an estate for your family members or beneficiaries. It’s that simple.

Equalizing Inheritance

It can be difficult to figure out the best way to divide up certain assets like real estate, a business, a family farm, or family heirlooms among multiple beneficiaries. This can be especially difficult if some have contributed more to a business, or the family farm, or have greater needs than others. Or sometimes you just have unequal amounts of money or property for each of them. You may worry that one heir might get shortchanged and cause tension among the family members. With life insurance, you can ensure that all your heirs will receive a fair inheritance regardless of their financial position in life.

Structuring Inheritance

Sometimes people cannot handle large sums of money, and parents may not want their children to receive large amounts of inheritance in a lump sum. Life insurance proceeds can be directed to a trust and kept there until children reach a specific age or until behavioral requirements are met prior to receiving an inheritance. Or a trust can dictate how much money can be distributed and how often. You don’t need to have a trust setup though it has some advantages. YOU can use beneficiary assignment to accomplish similar results. You can directly assign smaller amounts of benefits to those who may not be as good with money, or spread your benefit out so each person receives a more reasonable benefit. There are also a variety of ways to the way a death benefit is paid out to a beneficiary. These include; as a lump sum, being held in an account earning interest, period certain annuity payments, life income annuity payments, or full or partial survivor annuity as a period certain or lifetime income.

Providing Charitable Gifts

It’s no secret that people love to support their favorite charities. From cash donations to property and goods, Americans are generous when it comes to giving back. But while donating cash and property is a great way to show your support, sometimes you wish there was a way to do more. Well, guess what? There is! Enter life insurance donations—Upon death, life insurance policies pay out some or all of the death benefit directly to a charity without going through probate or estate tax.

Replacing Assets Given to Charity

Sometimes there are tax advantages in giving some or all of highly appreciated stock, business interests or other assets to charity. This is a common thought process for those charitably inclined “How do I save on taxes, benefit my favorite charities, and keep from taking away from my family’s inheritance?”. Life insurance can be a great addition to your plan. You may be able to buy life insurance to offset the loss to your beneficiaries in the event you gift money or assets to charities of your choice.

Using Life Insurance to Secure & Pay Off Debt

Paying Off Credit cards

Life insurance can provide much-needed relief for those who are saddled with credit card debt. In the event of your death, the proceeds from your life insurance policy can be used to pay off any outstanding debt you may have—including credit cards. This means that your family won’t have to shoulder the burden of paying off your debts after you’re gone, freeing up more resources they can use to cope with their loss.

Paying Off a Mortgage

Mortgage Replacement Life Insurance (MRLI) is an insurance policy intended to cover the balance of a home loan in the event of the insured person’s death. The idea behind this type of policy is that it will provide financial relief to the surviving family members who might otherwise be unable to pay off the remaining mortgage balance on their own. This type of policy essentially allows the surviving family members to pay off the existing mortgage, allowing them to remain in their home without having the burden of significantly adjusting their lifestyle.

Paying Off Auto Loans

In general, the assets in your estate are used to pay off your debts when you die. If there’s not enough money in the estate to settle the debt, it goes unpaid. However, there are circumstances where other people may be responsible for the remaining balance.

Cosigners and joint owners: If someone cosigns your debt, they’re typically responsible for it after you die. Similarly, a joint owner of the debt is equally accountable for it. So if you or the joint owner die, the surviving member must pay off the balance.

Spouses: In community property states, surviving spouses are responsible for debts left by deceased partners. Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin are community property states

[1] Alaska, South Dakota and Tennessee have elective community property rules. In some states, spouses may be responsible for certain debts like health care.

Even if no one is responsible for your debts after you die, you may still want coverage. A life insurance payout can help your beneficiaries pay off the debt so the money in your estate can go to your heirs. You can also use life insurance to leave a separate inheritance from your estate.

Paying Off Student Loans

Life insurance can provide much-needed relief for those who have student loan debt. In the event of your death, the proceeds from your life insurance policy can be used to pay off any outstanding debt you may have—including your student loans. This means that your family won’t have to shoulder the burden of paying off your debts after you’re gone, freeing up more resources they can use to cope with their loss.

How to Use Life Insurance While You’re Still Alive

Disability Income

The Monthly Disability Income Rider provides a monthly benefit, after the elimination period, if the insured becomes totally disabled (as described below) prior to the insured’s 65th birthday.

“Total disability” is a condition due to injury or sickness which keeps the insured from doing the important, substantial and material duties of their own occupation and requires a physician’s care unless the insured has reached the maximum point of recovery.

You have to add this rider to your life insurance quote and application (we make it really easy to do) and you can choose a monthly benefit between $300 through the lesser of $3,000 or 1.5 percent of base policy benefit amount; issue amounts rounded to the lowest $100 increment. Also limited to a maximum of 60 percent of the applicant’s gross earned monthly income (40 percent in California) and based on the total of all in-force and applied-for individual and group disability income benefits.

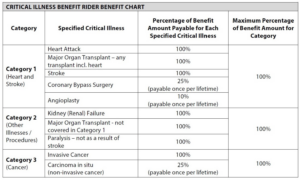

Critical Illness

Critical illness is a rider that can be part of your policy and provides some unique coverages while you are living. The Critical Illness Rider will pay a benefit if an insured person receives a first-ever diagnosis or procedure for one of the specified critical illnesses shown in the chart below. The amount payable is the percentage of the benefit amount found in the chart multiplied by the benefit amount.

You have to add this rider to your quote and application and you can add $20,000 through $100,000, but not exceeding the base policy benefit amount.

Return of Premium

The Endowment Benefit Rider provides for a return of premium (ROP) benefit that is paid to the owner upon termination of the policy for any reason other than the death of the insured. The Endowment Benefit is paid to the owner at the end of the level term period, at which point the rider terminates. If the rider terminates for any reason other than death prior to the end of the level term period, then the policyholder is entitled to receive a percentage of the following premiums: premiums paid for the term life base policy and premiums paid for the Endowment Benefit Rider (ROP). Flat extra and table rating premiums, other rider premiums, and the annual policy fee will be excluded.

This rider allows you to have the coverage you want, and then get some or all of your money back at the end of the term period. You have to add this rider to your quote and application and it’s available for a 20-year level premium period for Non-Tobacco users, 18 through 60, or for Tobacco users, 18 through 55. It’s also available for a 30-year level premium period, for ages 18 through 50.

Protect the Insurability of Your Children

Did you know you can add a rider to your term policy to provide death benefits for all of your children? That’s right, one rider, one small premium, and coverage for all of your children. The Children’s Term Insurance Rider provides level-term insurance to age 25 on the insured’s children listed on the original application and children born to or adopted by the insured while the policy and this rider are in force.

When this rider’s coverage terminates for an insured child, such insured child can purchase a new policy up to five times the face amount. Coverage for an insured child will terminate when they no longer meet the definition of a dependent child, or on the rider termination date, if sooner. If the conversion is requested prior to the termination date of an insured child’s coverage, the amount converted cannot be more than the face amount you purchased.

Life Insurance for Business Owners

Funding Buy-Sell Agreements

When it comes to running a successful business, there are a lot of important pieces to the puzzle. One of the most important, yet often overlooked, is having a buy-sell agreement in place.

A buy-sell agreement is essentially a contract between business owners that outlines what will happen if a triggering event occurs. These triggering events often include death, disability, retirement, or even if one of the owners wants to sell their stake in the company.

Having a buy-sell agreement in place is crucial for protecting the future of your business. Not only does it ensure that you have a plan for what will happen if an owner leaves, but it also can help prevent disagreements and disputes down the road.

Funding your buy-sell agreement with life insurance, means you or your partners have immediate funding and a pre-planned buyer for the shares of the deceased owner.

Key Person Insurance

Purchasing life insurance for the family is critical. Purchasing life insurance for the business may be even more important. No matter how well-run a company is there is a shock to the system when an owner or key employee dies.

Did you know that at the death of an owner, small to medium-sized businesses lose more than 60% of sales? And you may be like other small businesses that rely on 1 or 2 key employees, many of these businesses have a significant reduction in sales after the death of a key employee or are out of business within a few years. That’s scary.

Well-planned life insurance for your business is inexpensive and can help stabilize your cash flow and help you prepare for life without you or one of your key employees. So often, owners forget that the process to replace themselves or other key employees could be expensive at the time of need and the time it takes for the replacement employee or owner to get up to speed could be long and bumpy…all that takes money.

Employee Attraction and Retention Programs

Life insurance has become a key piece of an employment retention package, especially for senior managers and executives (this includes business partners as well). For example, key employees are that for a reason. They are critical to your operations and are well compensated.

But there is always someone with money to burn and your employees could get poached. A life insurance policy is an excellent tool to keep competitors away, especially one with added benefits like Critical Illness Riders, Disability Income Riders, or Return of Premium Riders. This type of policy (and riders) provides protection for the employee’s family through the life insurance death benefit and the return of premium (if purchased and available in your state) can be accessed by the employee at the end of the term policy.

Securing SBA Loans

If you have considered or are about to begin the application process for a Small Business Administration (SBA) loan you may be required to have a life insurance policy as collateral for the loan. Having life insurance backing your SBA loan can often improve the terms of your loan, even if you aren’t required to secure the life insurance.

With loans as large as $5 million it’s understandable the SBA would require life insurance to lower its risk of default.

The death benefit of the insurance you choose will have to be at least as much as the total amount of the loan. Term insurance is often the type of life insurance chosen because of its simplicity and flexibility. And it is required that your policy be active before the loan will be approved.

Which Type of Insurance is right for you?

Everyone has their own needs, wants, and wishes for buying life insurance. Ultimately the best life insurance policy is the one that pays out to your beneficiaries when you need it to. Working with a Quote-Bot will help you find a budget-conscious life insurance plan to make sure your family members or business partners are properly taken care of when you need them to be. Here are two of our most popular term life insurance products.

Fast Quoting Process

Our quoting process takes about a minute to complete and view your quote. We also instantly update your quote with any changes you would like to see, without having to start all over!

Instant Decision Underwriting

For many, you can go from our quote to a completed purchase in less than 10 minutes! Our Instant Decision process keeps you from having to wait around to see if you qualify.

Solutions That Fit Your Needs

We pride ourselves in providing high-quality and well-planned solutions no matter how big or small your need is. Our solutions will bring you from concept to completed purchase in minutes!

Frequently Asked Questions

Nuestro proceso y nuestras soluciones están diseñados para ayudar a eliminar la necesidad de hablar con un agente. Pero sí, puede hablar con un agente si lo desea. Puede utilizar la función de chat de esta página o llamar y hablar con un agente.

Our process and solutions are designed to help remove the need to talk with an agent. But yes, you can speak with an agent if you like. You can use the chat feature on this page or call and speak with an agent.

El impago de una prima es un asunto importante que hay que tener en cuenta y, afortunadamente, existen programas que le ayudan a recibir una notificación en caso de impago. Normalmente, dispone de un periodo de gracia de unos 30 días para efectuar el pago. La compañía de seguros le enviará un correo electrónico, pero también puede enviarle correo en papel, para informarle del problema de pago y darle instrucciones sobre cómo resolverlo. Si no efectúa ningún pago durante el Periodo de Gracia, tendrá que volver a someterse al proceso de suscripción para mantener su cobertura.

Missing a premium is an important thing to know about and thankfully there are programs in place to help notify you if you do miss a payment. Typically you have around a 30-day grace period to make your payment. The insurance company will email you but may send you paper mail, making you aware of the payment issue and giving you instructions on how to resolve it. If you do not make a payment during the Grace Period, you will have to go through underwriting again to keep your coverage.

Si tiene entre 18 y 50 años y solicita una prestación por defunción de hasta 1.000.000 $, o si tiene entre 51 y 65 años y solicita una prestación por defunción de hasta 500.000 $, es posible que no necesite someterse a un examen. Cuando presenta una solicitud fuera de esas edades o prestaciones por defunción, se le exige un examen médico. No te preocupes, te ayudaremos a organizarlo. Estos exámenes son obligatorios (si son necesarios) para que la compañía de seguros pueda comprobar si cumple los requisitos y el importe de la prima.

If you are age 18-50 and applying for up to $1,000,000 of Death Benefit, or ages 51-65 applying for up to $500,000 of Death Benefit, you may not need an exam! When you apply outside of those death benefits or ages, you are required to have a medical exam. Don’t worry, well will help arrange that for you. These exams are required (if needed) so the insurance company can verify your eligibility and your premium amount.

Decisión instantánea significa que le comunicaremos inmediatamente (posiblemente hasta en 90 segundos) si ha sido aprobado o no, si necesitamos más información, si ha sido rechazado o si necesita un examen. No hace falta esperar mucho para obtener respuestas.

Instant decision means that we will let you know immediately (possibly up to 90 seconds) whether or not you are approved, if we need more information, if you were declined or if you need an exam. No need to wait around very long for answers.

Nuestro proceso de Decisión Instantánea tarda 10 minutos en completarse para la mayoría. Algunos son más rápidos, otros más lentos. La buena noticia es que una vez que haya terminado de rellenar su solicitud, le daremos las respuestas al instante o en un plazo de 90 segundos más o menos. Es rápido.

Our Instant Decision process takes 10 minutes for most to complete. Some are faster, some are slower. The good news is that once your done with your application, we give you answers anywhere from instantly or up to a 90 second wait or so. It’s Fast!

No. Nos esforzamos por ofrecer una solución que le permita ir de principio a fin en cuestión de minutos sin necesidad de hablar con un agente.

No. We strive to provide a solution that allows you to go from beginning to end in minutes without the need for speaking to an agent.